Embarking on the journey to purchase an electric vehicle (EV) at Daniels Long Chevrolet is an exciting opportunity to embrace cutting-edge automotive technology while benefiting from substantial financial incentives. Colorado offers generous EV tax incentives that can significantly reduce the overall cost of your new vehicle, making it an economically savvy choice. At Daniels Long, you can explore a diverse range of electric vehicles designed to meet various needs and preferences, all while taking advantage of the state's commitment to promoting sustainable transportation. With expert guidance from the dealership's knowledgeable staff, you can navigate the available incentives and find the perfect EV to suit your lifestyle and budget.

Exploring Electric Vehicle Options at Daniels Long Chevrolet: Maximizing Colorado's EV Tax Incentives

Exploring Electric Vehicle Options at Daniels Long Chevrolet: Maximizing Colorado's EV Tax Incentives

Colorado State EV Tax Credits

- If you're a taxpayer in Colorado, you're eligible for a state tax credit when you buy or lease an electric vehicle. Currently, the Colorado EV tax credit is valued at $5,000 when you purchase or lease a new EV with MSRP up to $80,000. EVs with an MSRP under $35,000 are eligible for an additional tax credit of $2,500. For those who are eligible, the federal EV tax credit can add up to an additional $7,500 in savings!

- The Vehicle Exchange Colorado (VXC) program helps income-qualified Coloradans recycle and replace their old or high-emitting vehicles with electric vehicles. The VXC rebate will partially cover the upfront cost of the EV at the time of purchase or lease from an authorized automobile dealer. VXC participants can receive a rebate of $6,000 towards a new Battery Electric Vehicle (BEV) or Plug-in Hybrid Electric Vehicle (PHEV) with a manufacturer's suggested retail price (MSRP) or purchase price of $80,000 or less. Participants can receive $4,000 towards a used BEV or PHEV with a final negotiated purchase price of $50,000 or less.

- Combining the Federal Tax Incentive + Colorado State Tax Incentive + VXC = Up to $18,500 in rebates!

Charging Costs Compared to Gas Prices

One of the significant savings for electric vehicle (EV) drivers comes from the reduced cost of charging compared to gasoline. In Colorado, with an average home electricity rate of $0.13 per kilowatt-hour, you can save between 66% and 75% on refueling costs compared to gasoline.

What about charging on the go? Although public charging stations may cost more than home charging, they are often still less expensive than gasoline. For more information on the cost of public charging near you, visit Plugshare.com.

Maintenance Costs

Concerned that electric vehicles (EVs) might require more maintenance than your current gas-powered car? Think again! Fully electric cars have around 20 moving parts, compared to over 2,000 in gas-powered vehicles. This significantly reduces the number of parts that need maintenance over the car's lifespan, leading to lower maintenance costs.

Fully electric vehicles eliminate the need for oil changes, transmissions and transmission fluid, timing belts, spark plugs, and other components that require regular maintenance or repair. Additionally, your brakes last much longer thanks to regenerative braking.

Home Charging Benefits

Several utility companies in Colorado, including Xcel Energy, Black Hills Energy, Holy Cross Energy, San Isabel Electric Association, and Gunnison County Electric Association, provide additional incentives for residents in their service areas. Besides offering rebates, some utilities feature "time of use" rates, allowing residential customers to benefit from lower electricity prices for overnight charging. To explore all the utility incentives available in Colorado, visit the US Department of Energy's Alternative Fuels Data Center.

At this time, the Xcel Energy and Black Hills Energy EV rebates cannot be stacked with the state tax credit

- Xcel Energy: Income-qualified residential customers are eligible for rebates of $3,000 - $5,500 towards the lease or purchase of pre-owned and new EVs. Residential customers may be eligible for a rebate of up to $1,300 on home wiring costs related to installing a Level 2 charger.

- Holy Cross Energy: Residential customers are eligible for free chargers and will roll installation costs into your monthly bill, spreading it over 3 years to lower your upfront costs.

- San Isabel Electric Association: Residential customers are eligible for a rebate towards the purchase of qualified EVs.

- Gunnison County Electric Association: Residential customers are eligible for a rebate for 50% of the cost to purchase and install an EV charger, up to $1,250.

- Black Hills Energy: Residential customers are eligible for a $500 rebate towards the purchase and installation of an at-home Level 2 charger. Income-qualified residential customers can receive up to $1,300 in rebates towards the purchase and installation of an at-home Level 2 charger. Residential customers who are income qualified may receive rebates of up to $3,000-$5,500 towards the purchase of a new or pre-owned EV.

- United Power: Residential customers are offered the purchase and installation of a Level 2 charger at home for $19 per month, which also covers maintenance or repairs if needed. If you have your own charger, United Power offers a $1,000 rebate towards its installation.

- Yampa Valley Electric Association: Residential customers can be eligible for a $250 rebate towards the purchase and installation of a Level 2 charger.

- La Plata Electric Association: Residential customers can receive up to two at-home Level 2 EV chargers and up to $500 towards installation costs, or up to a $500 rebate off the price of your own at-home charger and installation costs.

- Poudre Valley Rural Electric Association: Residential members qualify for up to a 50% rebate on expenses associated with buying and installing an Electric Vehicle Charger, with a maximum rebate amount of $1,000.

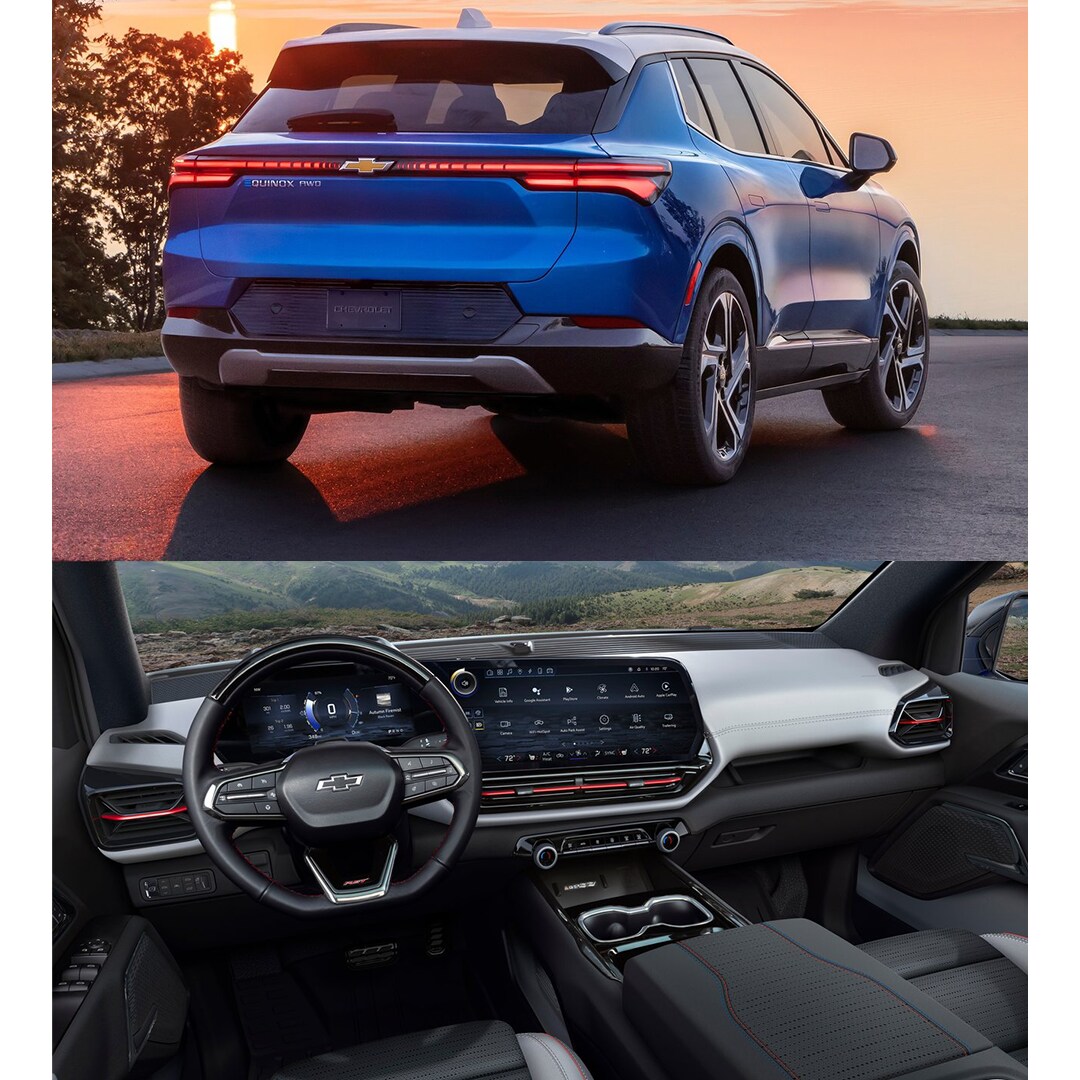

Buy a New Chevrolet EV

If you're a taxpayer in Colorado, you're eligible for a state tax credit when you buy an electric vehicle. Shop with Daniels Long Chevrolet!

Shop for New Chevy EVsLease a Chevrolet EV

Colorado taxpayers are eligible for a state tax credit when you lease a new EV. Lease agreements must have an initial term of at least two years!

Lease a Chevy EVBuy a Used Chevrolet EV

Eligible Coloradans can receive a rebate towards the purchase or lease of used BEV or PHEV. Shop with Daniels Long Chevrolet.

Shop for Used Chevy EVs